Powerful PSM 2.0 solutions to save on parcel shipping—wherever you are in your agreement cycle.

Whether you’re managing day to day operations, in the middle of your carrier agreement, or about to renegotiate, Reveel’s easy-to-use solutions put you in control of your shipping.

Easy to use, powered by AI.

Reveel is the only PSM 2.0 platform that used advanced analytics, modeling and simulation, statistical analysis, and machine generated real time insights to tell you where you can improve, and what to do about it.

Compare your shipping operations against your peers

Identify areas for improvement

Get real time actionable insights on ways to save.

Work more effectively with your carrier.

Parcel Shipping Analytics Solution

Like a data analyst at your fingertips

Reveel’s parcel shipping analytics solution takes complex shipping invoice data, cleanses and normalizes it, then presents it in an easy to use app. Advanced analytics combs through mountains of data to find the needles in the haystack that can save you money.

What’s Included in Reveel’s Parcel Shipping Analytics

Vital Factor Dashboards

Actionable Insights

Drill Down Reporting

Enterprise Class Business Intelligence

Contract Management Solution

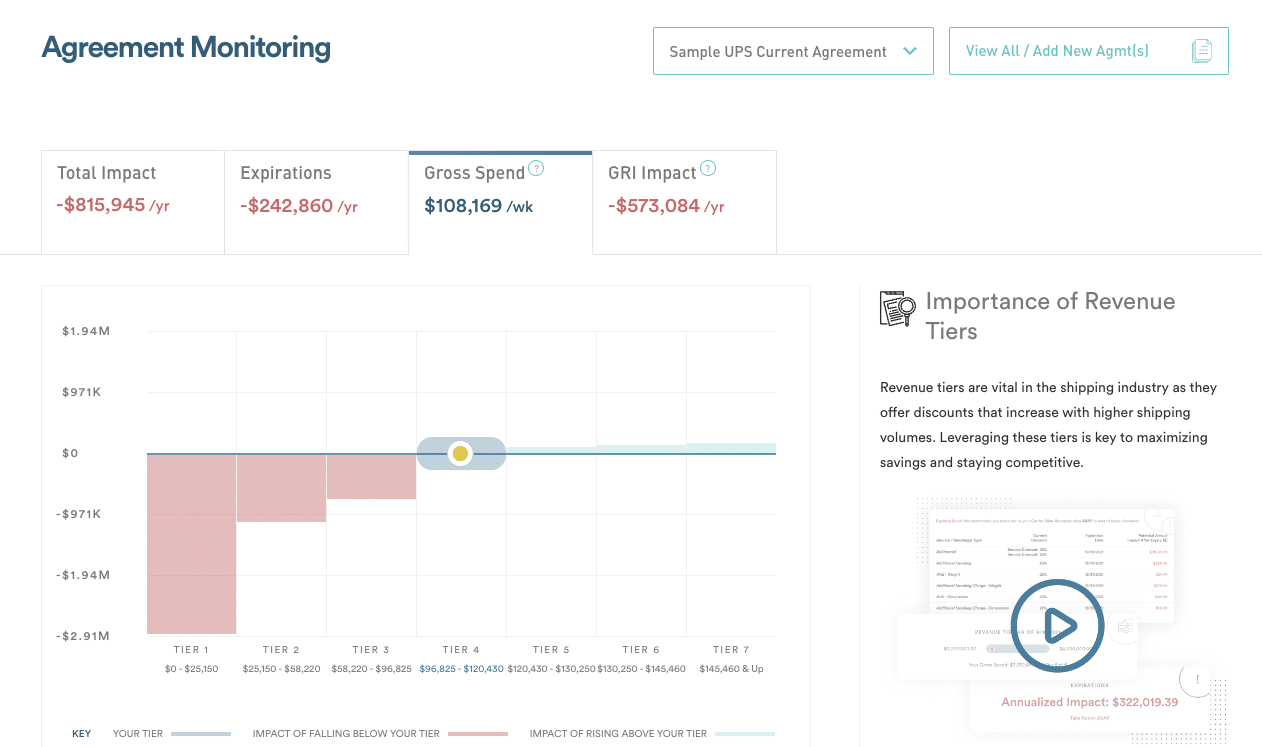

No surprises, Never lose a discount again

Reveel’s contract management solution eliminates the big surprise because a discount expired, you dropped a revenue tier, or you underestimated your General Rate Increase impact. Our tech is like 24/7 surveillance to ensure your agreement is as optimized today as the day you signed it.

What’s Included in Reveel’s Contract Management

Agreement Monitoring for expiring discounts

Agreement Monitoring for earned discount revenue tiers

General Rate Increase impact analysis

Manage multiple agreements at the same time

Parcel Audit & Recovery Solution

Get every last credit you’re owed—free. No, really, free.

Every year, 75% of parcel audit credits owed by UPS and FedEx go unclaimed. That’s $1.25 billion worth of credits! How much of that money is yours? Reveel finds and recovers every credit you’re owed by your carrier. The best part? It’s absolutely free. No catch, no strings attached.

What’s Included in Reveel’s Parcel Audit Software

The total dollar amount you’re owed

We even call to appeal denied credits!

A breakdown of credit types

Did we mention it’s free?

You keep 100% of your credits

Finance Automation Solution

Make better decisions and close the books faster

What’s Included in Reveel’s Finance Automation

GL Coding

Order Matching

ERP integration

Accrual Management

SKU Level Profitability

Drill down business intelligence

Modeling & Simulation Solution

Run Complex Scenarios and Get the Answers You Need in Real Time

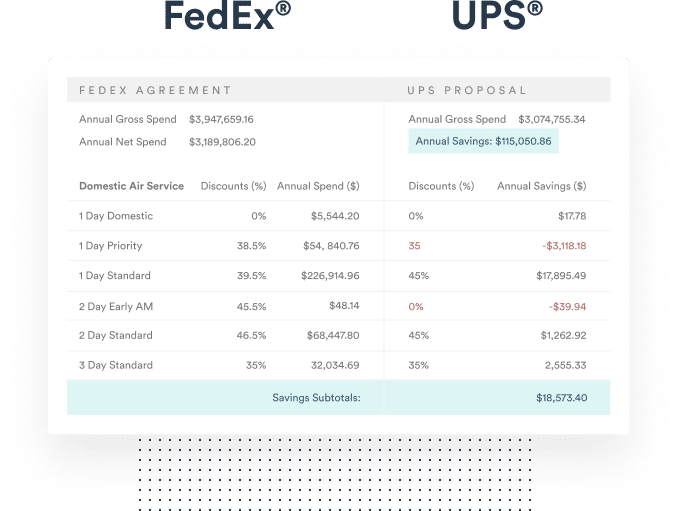

Modeling and Simulation is at the heart of Parcel Spend Management 2.0. By creating digital models of your carrier agreements and using actual shipment data to run simulations of different scenarios, you’re able to gain visibility into the black box of parcel shipping.

You get refreshing clarity on the actual savings generated by each agreement.

What’s Included in Reveel’s Modeling and Simulation

Drag and Drop PDF agreements to automatically build model

Compare normalized agreements side-by-side

Select scenarios to model

Perform what if analysis by running simulations

Model precise impact of rate changes

Saving money

shouldn’t be this easy.

Our simple-to-use platform turns complex shipping data into crystal clear ways to save money—today. It’s really that easy.

01

Create Account

Getting started is simple. Just fill out a form with a few pieces of important information, and you’re good to go.

02

Get Connected

Securely sync your carrier account to connect to Reveel’s powerful data analytics platform.

03

Start Saving Today

Boom…we crunch the data and you get concrete ways to save money on shipping today. It’s so easy, you’ll wish you’d done it sooner.

Take it from our Customers…

“Nisolo is brand of ethically made shoes and accessories that ships directly to the consumer. See how they saved around 22% of their shipping costs with Reveel’s Shipping Intelligence®.”

“After lengthy negotiations, Redcat Racing ultimately stayed with UPS. They were able to drastically reduce their dimensional weight, saving them over $53,000 in annual shipping costs.”

“We gave Brandon and Gunner Kennels early access to our Shipping Intelligence® Platform to see how it could support his operational efforts and save money.