Parcel Spend Management 2.0

Reveel is the only Parcel Spend Management (PSM) 2.0 shipping intelligence platform that leverages advanced analytics, modeling and simulation, statistical analysis, and real-time insights to transform complex shipping data into simple ways to save money, doing the hard work for you.

Technology is a disrupter, because it empowers the user!

The only shipping intelligence platform that empowers you to ship smarter.

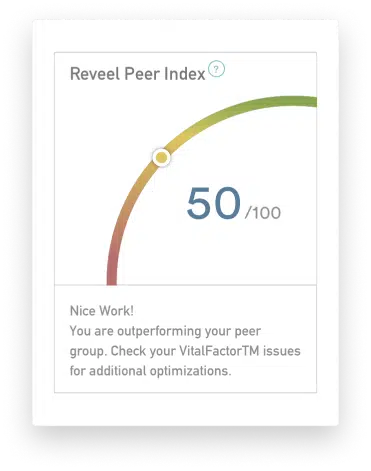

Reveel Peer Index®

Start by seeing how your shipping health score compares to businesses like yours. It’s one number, packed full of data.

Vital Factors™

Now that you know your score, see where you’re doing well and where you have room for improvement.

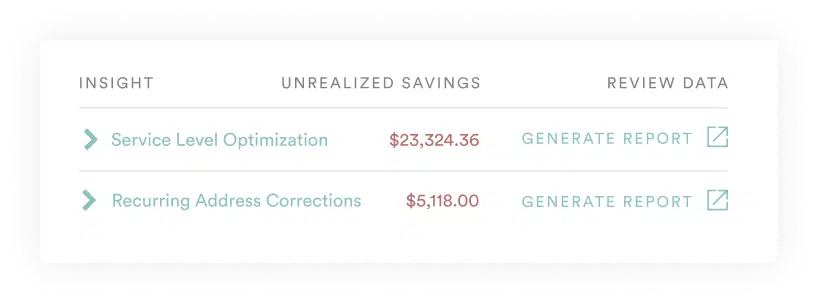

Actionable Insights

Finally, see exactly what to do in each area to save money and improve your RPI. It’s just that easy.

Ship smarter with easy-to-use solutions

powered by A.I. technology.

Shipping

Analytics

Analytics

Contract

Management

Management

Parcel

Audit

Audit

Finance

Automation

Automation

Modeling

& Simulation

& Simulation

Shipping

Analytics

Analytics

Contract

Management

Management

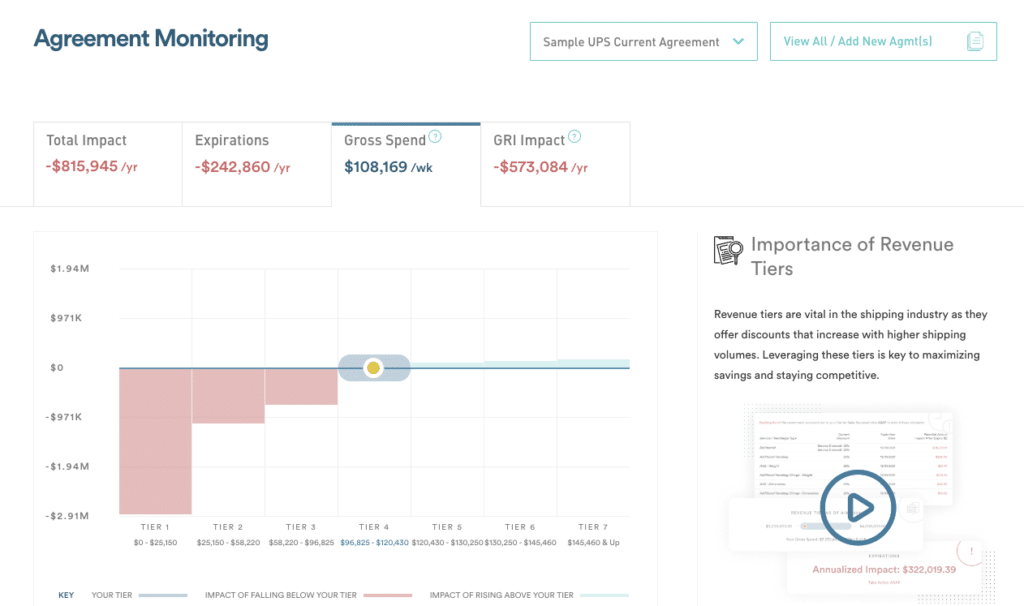

Contract Management

Ensure your carrier contract stays optimized over time so you never have to worry about losing a discount again.

Parcel

Audit

Audit

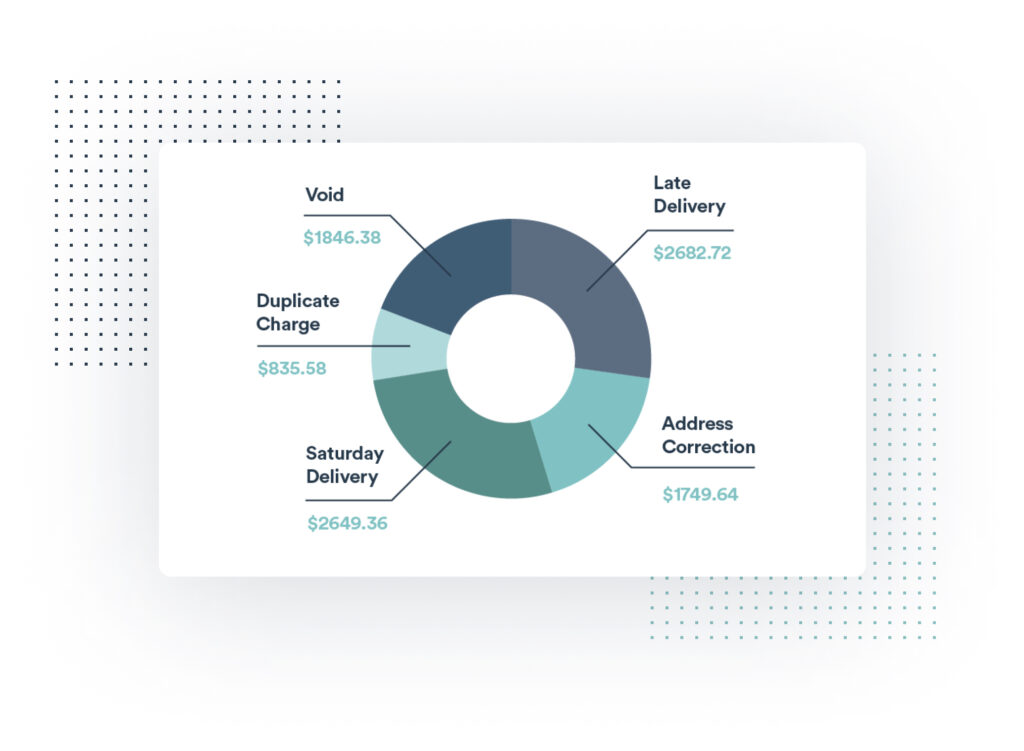

Parcel Audit

Automatically analyze shipping invoices and get every last shipping credit you’re owed absolutely free. Really. There’s no catch

Finance

Automation

Automation

Finance Automation

Make better decisions and close the books faster with precise financials with GL Coding, Accrual Management, and Order Matching.

Modeling

& Simulation

& Simulation

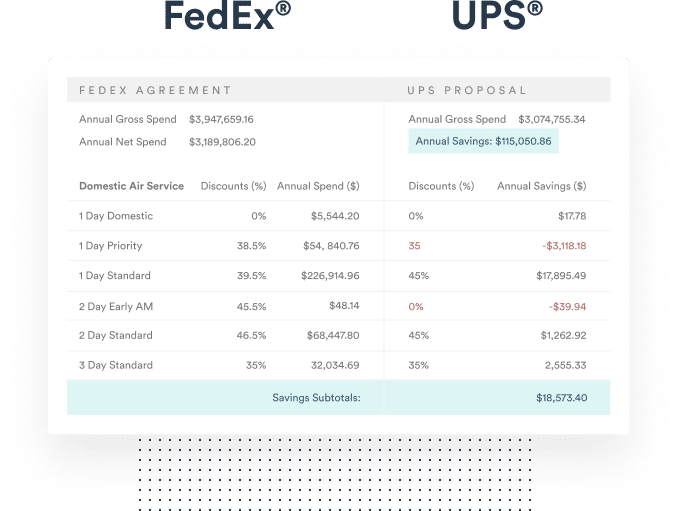

Be your company’s shipping guru. Gain a better understanding of your shipping profile, compare agreements side-by-side, continuously improve operations, and forecast future spend.

Play Video

The numbers don't lie.

$

0

m

Total Savings

0

m

Lines of Shipping Data

$

0

b+

Transportation spend under management

0

%

Average cost savings potential

See how businesses like yours are saving money on shipping with Reveel…

“White Labs partnered with Shipping Intelligence® company Reveel 6 years ago when they were looking to cut their shipping costs and recoup savings from their carrier.”

Kathryn Small

Chief of Staff, White Lab

FAQs

What is parcel spend management software?

Parcel shipping spend management is a process of compiling expenses that are incurred from carriers, auditing those expenses, and finding ways to reduce your shipping expenses; ensuring you are getting the best shipping rates possible. Parcel spend management software is a technological solution that makes this process more efficient by automating the analysis of vast amounts of data. In the past, companies would have to hire a shipping consultant to manually comb through this data and find opportunities for savings. This investment in human resources can increase your administrative costs to a level that will effectively erode any cost efficiencies achieved by selecting the best cost shipping solution. Today, most companies that rely on shipping can easily do this themselves with the help of our parcel spend management software.

Reveel takes parcel spend analysis one step further by providing you with a reference point on how much other companies that are similar to yours spend in shipping. These are not necessarily your competitors, but other organizations that spend a similar amount in shipping, and ship a similar amount of packages. This gives you added transparency into your shipping fees, and helps you eliminate any blind spots in your operations.

What’s the difference between parcel spend intelligence and logistics intelligence?

Parcel spend intelligence is focused on identifying insights specific to how much you are spending with parcel shipping carriers. It aggregates a vast array of data related to your shipping costs and presents this information in a simple format that is easy to interpret, providing you with actionable solutions that can inform senior-level decision-making.

Logistics Intelligence is focused on other aspects of delivery, like which mode of transportation is optimal, which routes should be used, or how much inventory is available in a warehouse.

Reveel is a shipping intelligence platform, the former, that is designed to transform complex parcel shipping data into simple ways to save money.

How did companies manage their carrier data before Reveel?

Traditionally, to find out if you were getting the lowest shipping rates you would run multiple spreadsheets and engage with several carriers on flexible-term contracts to suit your needs. You might suspect that greater savings could be achieved without sacrificing quality, but you would have no evidence to substantiate this belief. Instead, your administrative staff would spend many hours regularly reviewing parcel spend and seeking viable efficiency measures.

Luckily, there is a better way.

The Reveel’s shipping management tool will consolidate and simplify this analysis process and produce insights that can inform business decisions, ultimately resulting in cost and time efficiencies that can improve the overall profitability of your business significantly.

What are the most important metrics to track with a parcel spend management software?

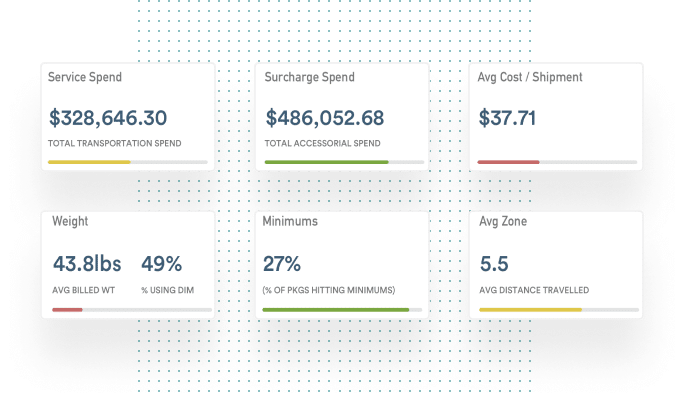

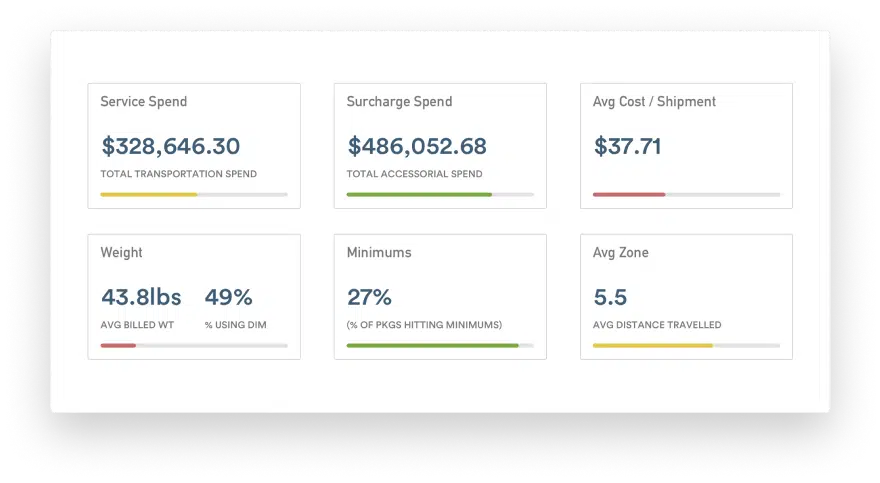

Before developing Reveel, we interviewed nearly 400 shippers and we asked them the question: “What are the things that are most important to you when you manage your parcel spend?” They came back with these six things.

1) Service spend

2) Average cost per package,

3) Percent of packages hitting the minimum

4) Surcharge Spend

5) Average package weight and dimensions

6) Average distance traveled

That’s why we include all of these metrics on our summary dashboard. Each metric also provides more insight into how you compare with other people who ship like you.

Read our VitalFactors® page for more.