Reveel Blog

- Reveel

- April 9, 2024

You’d be forgiven if you thought this was an old headline or a repeat of a blog from the pandemic timeframe. Unfortunately, that’s not the case. Both UPS and FedEx have unexpectedly decided to increase the rates for certain zip codes beginning on April 8th for UPS and on April 15th for FedEx. What You […]

- Josh Dunham

- April 5, 2024

FedEx offers the opportunity for shippers to track just about every package as it moves across the globe. The vast majority of those packages — nearly 98 percent in 2023 during the rush between Black Friday and Cyber Monday — arrive on time. Shippers and customers alike can use a tracking number to watch packages […]

- Reveel

- April 2, 2024

In the rapidly evolving and intricate domain of parcel shipping, the analysis of invoice data is a critical component for maintaining cost-efficiency and optimizing operations. While off-the-shelf Business Intelligence (BI) tools offer a broad spectrum of data analysis capabilities, they often fall short in effectively handling the specialized requirements of parcel shipping invoice data. This […]

- Reveel

- March 8, 2024

In the fast-paced world of logistics and shipping, businesses continuously seek efficient and accurate methods to predict and manage costs. The General Rate Increase (GRI) by major carriers like FedEx and UPS is a significant annual event that impacts the bottom line of companies reliant on parcel shipping services. Traditional methods like spreadsheets or the […]

- Reveel

- February 27, 2024

In our interconnected digital world, where data breaches are not just a risk but a daily headline, the importance of robust security measures cannot be overstated. One critical benchmark for assessing the trustworthiness of service providers, particularly those handling customer data, is SOC 2 certification. If your provider is not SOC 2 certified, your data […]

- Reveel

- February 16, 2024

Reveel’s security and compliance principles guide how we deliver our products and services, enabling people to access the digital world simply and securely. Learn more about our security measures and how our processes enabled the Reveel team to complete the prestigious AICPA Service Organization Control (SOC) 2 Type II audit. Secure Personnel Reveel takes the […]

- Reveel

- January 9, 2024

In the heart of Colorado, Motion Flow & Control Products (MFCP) stands out as a powerhouse distributor, specializing in industrial products with a focus on hydraulics and pneumatics components. While their extensive product range and physical presence in over 60 brick-and-mortar locations across multiple states contribute to their success, the real game-changer lies in their […]

- Reveel

- December 26, 2023

The better-than-expected performance of the parcel shipping industry during this year’s peak season, which spans from Black Friday to Christmas, has been an encouraging sign of resilience and adaptability. This period is crucial for parcel shippers, as it’s when they handle the highest volume of shipments. This year, the industry not only met but exceeded […]

- Reveel

- December 21, 2023

In the world of parcel shipping, financial compliance and governance rely significantly on two key elements: General Ledger (GL) coding and order matching. These fundamental processes streamline financial management and drive efficiency in shipping operations. GL coding and order matching are vital in parcel shipping for financial governance and accuracy. GL coding categorizes expenses, aiding […]

- Reveel

- December 12, 2023

As the festive season approaches, businesses prepare not only for celebrations but also for the surge in shipping demands that accompany this time of the year. Amidst the holiday cheer, managing the challenges of shipping becomes pivotal for companies striving to uphold timely deliveries and satisfy their clientele. Grasping the Dynamics of Holiday Shipping from […]

- Reveel

- December 4, 2023

Gaining a New Edge in Parcel Spend Management: How to Eliminate Wasted Spend with Paccurate and Reveel What does packaging have to do with parcel spend management? Paccurate and Reveel have teamed up to deliver actionable insights to shippers looking to reduce their transportation costs. This feedback loop empowers shippers to measure, execute, and monitor […]

- Marc Aliotta

- November 14, 2023

Across the globe, ShipERP is known for empowering businesses of all kinds to integrate their shipping operations directly into enterprise resource planning (ERP) systems. In today’s world, it is imperative for enterprise organizations to integrate shipping operations with their respective ERP systems to better meet customer demand. By using ShipERP, companies and their customers are […]

- Marc Aliotta

- November 9, 2023

It’s no secret that shippers have a long and complicated history with carriers’ invoices. Thesurprises that often accompany them were a catalyst for the founding of Reveel in 2006 and ourongoing mission to help shippers level the playing field with carriers. Most veteran shippers will tell you that some of their worst professional experiences involvecarrier […]

- Reveel

- October 30, 2023

FedEx SmartPost, a familiar name in the world of shipping, underwent a significant transformation in early 2021, marking the end of an era in its 14-year history. As e-commerce boomed and consumer demands evolved, FedEx recognized the need to revamp its services. The result was the rebranding of SmartPost to the more dynamic and streamlined […]

- Josh Dunham

- October 23, 2023

Economic downturns are a testing ground for innovation, and history proves that disruptive technology thrives in the face of adversity. We’re currently living in a state of economic uncertainty, where the overall economic indicators are solid but companies continue to cut costs and look to make operations more cost-effective. Despite these actions, I believe that […]

- Reveel

- October 9, 2023

Are you ready to take your parcel spend management to the next level? Join us on October 18th, 2023, at 2:00 PM ET for an insightful live webinar hosted by Reveel, a leading name in optimizing parcel spend management. In this one-hour session, we’ll delve into the four key success factors that can transform the […]

- Reveel

- October 3, 2023

The Parcel Forum 2023 in Nashville, held recently, was nothing short of a landmark event for Reveel. As one of the leading players in the shipping and logistics industry, we had the privilege of participating in a panel discussion on “The 4 Key Steps to Active Shipping Management.” This forum provided a unique platform for […]

- Josh Dunham

- September 27, 2023

As expected, UPS announced its annual GRI (General Rate Increase) for 2024 and it’s exactly the same as FedEx announced earlier – a 5.9% increase. Given the history of the big two historically matching each other’s rate increases, this comes as no surprise. There was also little chance that UPS – after having agreed to […]

- Reveel

- September 18, 2023

Company Leader Recognized for Her Efforts in Helping Bring Pricing Transparency to the Parcel Shipping Industry Through Data Science IRVINE, Calif. – September 18, 2023 – Reveel, whose Shipping Intelligence™ Platform enables companies to level the playing field with carriers, today announced that Food Logistics, the only publication exclusively dedicated to covering the movement of […]

- Reveel

- September 11, 2023

On Tuesday, September 12, 2023 at 9:00 am CDT in room 301, Reveel CEO and co-founder, Josh Dunham, will be moderating a panel discussion on the topic of “Measuring Your Value: How Small And Medium-Sized Businesses Can Get The Most From The National Carriers.” Josh will be joined by other experts in the shipping industry […]

- Josh Dunham

- August 31, 2023

This week, FedEx took the opportunity to be the first of the big two carriers to announce their general rate increase, or GRI, for 2024. They announced that rates would increase 5.9% over last year – but the important part to note is that this year the increase is less than what shippers experienced last […]

- Josh Dunham

- August 15, 2023

We’re thrilled to share that Reveel will be attending Parcel Forum once again. This year’s event is taking place at the Gaylord Opryland Resort & Convention Center in Nashville, TN, from September 11-13, 2023. Our team will be on-site in booth #1029, where we’ll be highlighting new market disrupting updates to our Shipping Intelligence™ Platform […]

- Josh Dunham

- August 8, 2023

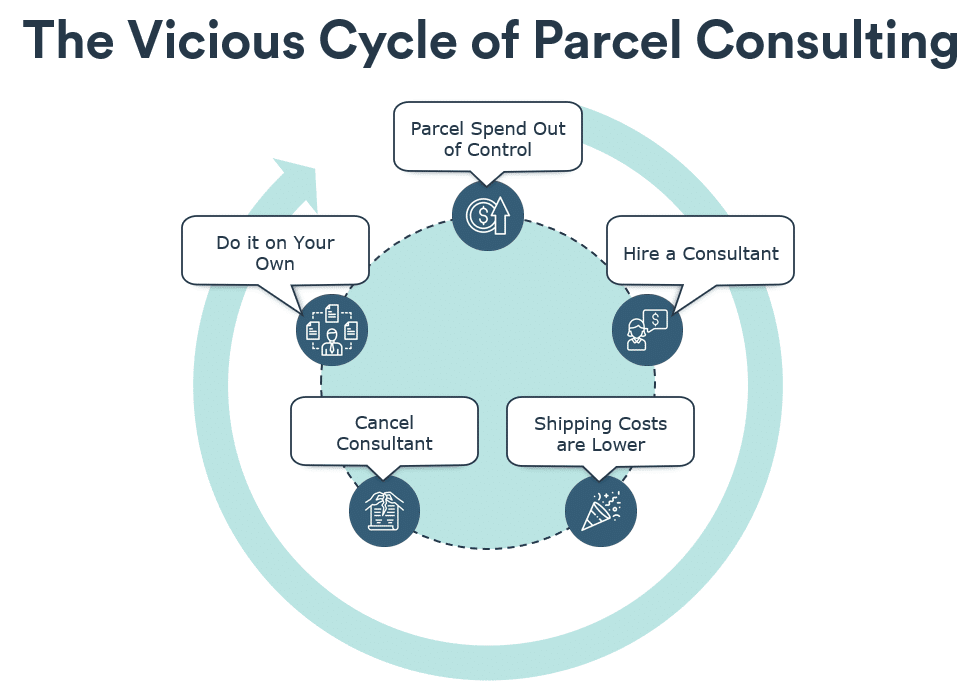

As anyone reading this knows, shipping costs are a significant challenge for small and mid-sized businesses, often spiraling out of control with the potential to negatively impact the bottom line. Frustrated by rising expenses and unsure of how to address the issue, many companies turn to parcel spend consultants for help. While these consultants can […]

- Josh Dunham

- August 1, 2023

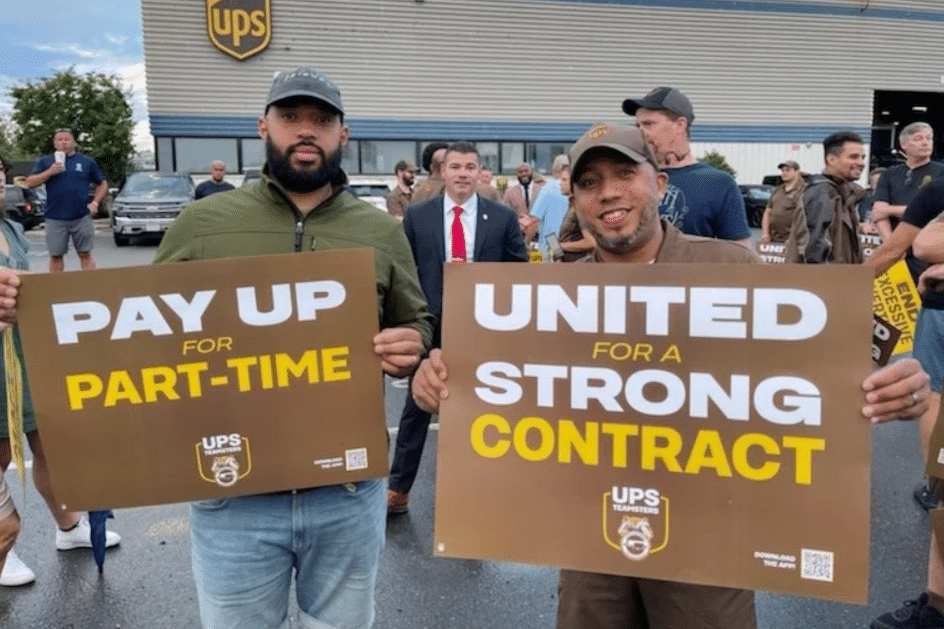

UPS and the Teamsters have successfully reached a tentative labor agreement, potentially averting a strike that could have had severe repercussions for the US supply chains and the economy as a whole. The agreement, which is still subject to ratification by approximately 340,000 Teamsters members at UPS, comes amid a growing sense of empowerment within […]

- Marc Aliotta

- July 28, 2023

We’re all about savings here at Reveel, and that’s why we have partnered with Cubiscan, the global leader in dimensioning with thousands of installations at many of the world’s largest companies. It’s no secret that accurate dimensions and weight are essential for warehousing, distribution,right- size packaging, and freight manifesting applications. Cubiscan develops innovative solutions for […]

- Josh Dunham

- July 12, 2023

In the world of e-commerce and global trade, efficient shipping and logistics management are vital for businesses seeking to thrive. That’s where Reveel comes in. Reveel is a professional logistics and shipping management platform that harnesses the power of machine learning to simplify the complex world of shipping, helping businesses save money and streamline their […]

- Josh Dunham

- July 6, 2023

In today’s environmentally conscious world, businesses across various industries are embracing sustainability as a core value. The parcel shipping industry, responsible for transporting millions of packages daily, has a significant role to play in reducing its environmental impact. By implementing eco-friendly practices and innovative strategies, companies can contribute to a greener future while maintaining efficient […]

- Josh Dunham

- June 28, 2023

MindWorks Innovations is best known for BrainMD, the leading brand of dietary supplements, books and resources devoted to, and focused on, brain health. Based in Irvine, Calif., the company is owned by Daniel G. Amen, M.D., celebrated psychiatrist and founder and CEO of both MindWorks Innovations and Amen Clinics, a network of clinics that provide […]

- Josh Dunham

- June 22, 2023

We had a great time in Philly last week at the 2023 Home Delivery World conference, where we caught up with old friends and made new ones among the industry leaders, clients and partners in attendance. It was a great opportunity to share how we are helping retailers thrive even as parcel shipping costs continue […]

- Josh Dunham

- June 12, 2023

For years, shippers have operated blind with little visibility into their shipping activity or ability to analyze the many thousands of shipments they might make in a given day – let alone benefit from the ability to know if their existing carrier contract is optimal or even if they are losing money. More than a […]

- Josh Dunham

- May 12, 2023

Unless you’ve been living under a rock these past few months, you’ve heard of ChatGPT and how the tool brought generative AI technology to the masses, educating much of the populace on just what artificial intelligence (AI) can do. Here at Reveel, we understand the power of data, analytics and AI – and how when […]

- Josh Dunham

- April 18, 2023

In the shipping industry, relationships with unions are not as common as they were in past decades, but we still see their presence in a major way in the recent news with Amazon and–more recently–with the long-standing connection between Teamsters and the United Parcel Service. With contract negotiations beginning between the union and UPS, many […]

- Josh Dunham

- April 4, 2023

Whether companies are rushing to find savings among their high-volume shipping contracts, or leverage business intelligence to help them ship smarter, shipping in 2023 has changed dramatically from the industry we had pre-COVID. As the industry continues to supplement their operations with more flexible practices and still take steps to keep costs down among the […]

- Josh Dunham

- March 21, 2023

Over the years, the shipping industry has grown to include more than just UPS, FedEx, and the USPS. Today, there are more small and mid-sized carriers, last mile delivery services, and other supplemental service providers that continue to gradually change the landscape of shipping and how parcel carriers operate today. With all these options available, […]

- Josh Dunham

- March 10, 2023

Technology is transforming parcel shipping operations and the procurement of transportation in the supply chain. In previous blog posts we shared with you why the Reveel Shipping Intelligence Platform™ and more specifically the ability its advanced data science and modeling capabilities give shippers to optimize their parcel operations, compare contracts and uncover opportunities to save […]

- Josh Dunham

- March 7, 2023

As the majority of ecommerce consumers have grown to expect fast, free shipping options, more companies are being pressured into providing this level of service to stay competitive. In order to do so, many high-volume shippers look for opportunities to correct any inefficiencies under their control and decrease their shipping costs. One of the key […]

- Josh Dunham

- February 21, 2023

- Josh Dunham

- February 7, 2023

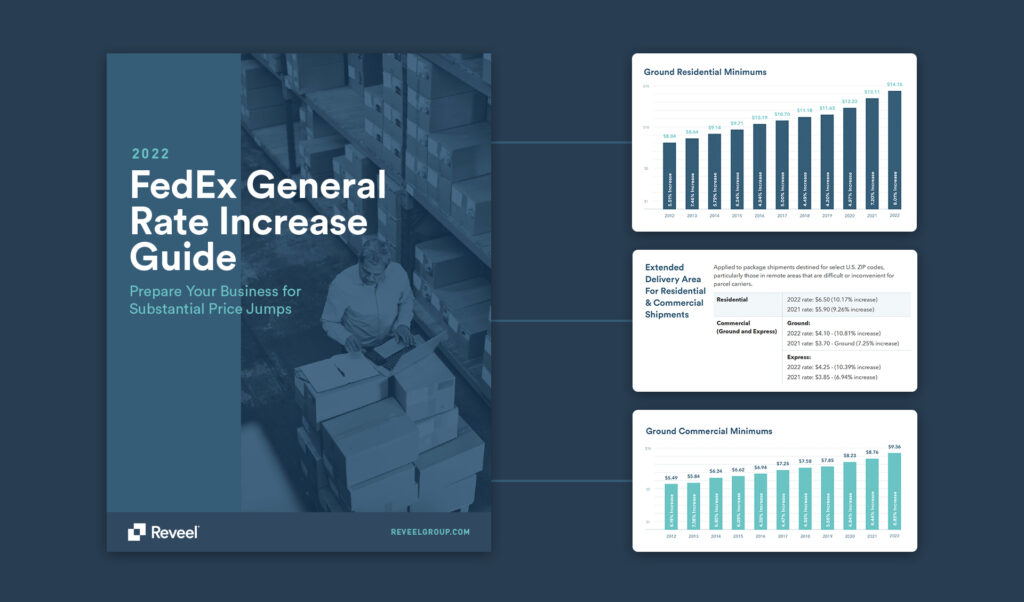

If you thought “unprecedented” described the increases we saw from the two major carriers in 2022, this year’s FedEx and UPS GRI will turn that perspective on its head. As businesses of all sizes continue to scramble to find savings to offset the weight of these heavy annual increases, the major parcel carriers have again […]

- Josh Dunham

- January 31, 2023

When it comes to shipping contracts, the specifics of your and your carrier’s responsibilities may be detailed in between a bunch of legal jargon that’s difficult to sift through. Understanding what both you and the carrier are liable for is essential to your compliance and your bottom line, so let’s take a look at these […]

- Josh Dunham

- January 14, 2023

As each major carrier continues to increase their rates year after year, surcharges are one of the biggest areas shippers see snowball into a major expense. As frustrating as this can be, there are ways to avoid some of the most common surcharges applied by UPS and FedEx so you can save your bottom line. […]

- Josh Dunham

- December 17, 2022

https://youtu.be/Y2Sgu_1e8k8 SupplyChainBrain is the most comprehensive resource for supply chain management information today. The wide range of multi-media formats addresses everything from the fundamental principles of supply-chain management and emerging trends to the latest technologies and cutting-edge solutions and features pieces written by the world’s most influential supply chain executives. Recently, our founder, Josh Dunham, […]

- Josh Dunham

- December 15, 2022

With the regular general rate increase of each major carrier hitting shippers year after year, there are a variety of shipping management processes and strategies anyone can implement to save both time and money, and minimize downtime or additional surcharges to help offset the rate increases. If you’re looking to give your shipping logistics an […]

- Josh Dunham

- December 1, 2022

As a shipper, you’ve likely encountered the long list of accessorial fees and surcharges that major parcel carriers lean on for revenue. While this mountain of additional expenses may seem insurmountable, it’s one of the best areas to find savings on your shipping logistics each month, one of which is the FedEx and UPS address […]

- Josh Dunham

- November 12, 2022

Now that 2022 has almost come to a close, it’s time to start preparing for the new rate increases that all the major parcel carriers recently announced. Since we’ve already discussed how FedEx increased their rates and introduced new surcharges, it’s time we look at our country’s other major carrier: UPS. With the millions of […]

- Josh Dunham

- October 21, 2022

We’re nearing the end of Q4, so that means all the major carriers have announced how they plan to change, introduce, and increase their rates for the 2023 year. As one of the largest carriers worldwide, FedEx is relied on by shippers across the continental U.S., so their rate increases have a widespread impact on […]

- Josh Dunham

- October 7, 2022

For many years, shipping consultants have largely operated under a gain share business model in which they received a percentage of the savings they uncover. This percentage, the consultant’s pay if you will, stemmed from a variety of sources, among them savings generated by the more favorable shipping contracts with carriers they helped negotiate and […]

- Josh Dunham

- August 25, 2022

Parcel carriers hold much of the power in the shipping industry by controlling the rates we pay, changing the services they offer, and by contributing to your customer’s experience with you. So, it’s only safe to assume that they control our contracts with them, right? Not quite, but that’s not the only myth businesses hear […]

- Josh Dunham

- July 19, 2022

With more and more new businesses emerging every day and contributing to the already competitive market, it’s vital to monitor the factors that contribute to your growth and keep you accountable for your success. However, with all that you have on your plate, how are you supposed to know which aspects of your shipping and […]

- Josh Dunham

- July 7, 2022

If the carriers’ earnings calls increasingly leave you with a sense of déjà vu, you are not alone. Regardless of shipping volumes, macroeconomic conditions or geopolitical events, revenue increases for carriers and price increases for shippers are the new normal. FedEx’s Q4 and FY 2022 earnings reported on June 23, 2022 were no exception. Revenue […]

- Josh Dunham

- July 5, 2022

We often use the terms shipping and logistics management interchangeably, so it’s easy to think that they address the same subject. While both discuss the planning, implementation, and execution of the shipment system, there is a big difference between the two. No matter if your business focuses on serving B2B or B2C, the two terms […]

- Josh Dunham

- June 10, 2022

The pandemic may have disrupted the global supply chain, but eCommerce is booming. Ecommerce sales are expected to reach $5.5 trillion by 2022, and the shipping industry is expected to grow along with it. To keep up with the competition and ensure shipments are running smoothly, you need to track the right shipping key performance […]

- Josh Dunham

- May 12, 2022

Carrier Contract Negotiations: 8 Effective Tips To Consider With industry outlooks like parcel shipping becoming even more expensive in 2022, contract negotiations are more important than ever. Failing to negotiate your carrier contracts could be the difference between a healthy margin and losses. This article will go over eight carrier contract negotiation tips that you […]

- Josh Dunham

- April 29, 2022

Even in ordinary times, shipping costs make up a significant portion of a business’s expenses. However, when the COVID-19 pandemic disrupted supply chains, shipping costs worldwide skyrocketed. According to McKinsey, shipping a container from China to Europe costs up to six times more now than it did at the beginning of 2019. Despite these challenges, […]

- Josh Dunham

- April 15, 2022

Fuel prices are rising – and they’re starting to have an effect on what you pay carriers to ship goods to your customers. Inflation was already raising the cost of doing business, and that, combined with the large general rate increases the big two carriers had announced, already meant you’d be likely spending more on […]

- Josh Dunham

- April 12, 2022

The Yellow companies, including Reddaway, Holland, YRC Freight, and New Penn carried out a 5.9% general rate increase (GRI) in base rates for non-contractual shipments in Canada and the US. Effective November 8, 2021, this GRI aims to balance the economic impact of rising supply costs and new rules across the shipping and transportation sector. […]

- Josh Dunham

- April 8, 2022

The supply-chain crisis and the e-commerce boom of the last two years have resulted in record earnings for FedEx, but it has also presented numerous difficulties. Despite adopting a contractor strategy designed to reduce spending, the multinational logistics company has struggled to cut costs. This spells bad news for the nearly 6,000 small businesses that […]

- Josh Dunham

- January 27, 2022

Our Shipping Intelligence® platform analyzes thousands of shipping agreements, models them, and runs them through simulations to give our customers data driven analysis. Now that FedEx and UPS rate increases are in effect for 2022, our data scientists took a deep dive into the impact shippers should expect to see and the results are not […]

- Josh Dunham

- December 21, 2021

2021 presented logistical challenges for businesses across the board. Rising inflation, shipping delays, and labor shortages are just a start to the laundry list of problems that created the perfect storm for an unpredictable shipping environment. And amongst the chaos, FedEx continues to pass on these challenges to their customers to pad their bottom line. […]

- Josh Dunham

- December 16, 2021

With FedEx and UPS seeing greater demand for parcel shipment volumes than ever before there’s no question it’s a difficult negotiation climate; however carriers are making agreements. Now is the time for all shippers to negotiate their 2022 contracts. It’s never been more important to be informed and prepared in order to secure the best […]

- Josh Dunham

- December 13, 2021

It is right to assume that current market conditions are driving up the cost of shipping, but rate increases are nothing new to the world of shipping. In fact, UPS implements a general rate increase, or GRI, year over year. Let’s take a look at what this entails. The General Rate Increase for 2022 On […]

- Josh Dunham

- November 10, 2021

UPS announced their general rate increase for 2022 and it’s a hefty average of 5.9%. To no one’s surprise, it matches the same substantial jump FedEx announced earlier this month. UPS’ average rate increases have gone hand in hand with FedEx’s for many years, which also makes this the biggest jump since 2013. Here’s a […]

- Josh Dunham

- November 2, 2021

On Tuesday, October 26th, UPS announced an annual rate increase of 5.9% for 2022 on their earnings call. Last year, we saw a 4.9% increase in shipping prices that affected businesses’ across the country. If shipping is an integral part of your business, you need to know how this will affect your bottom line and […]

- Josh Dunham

- October 26, 2021

What do you get when two last-mile delivery services join forces? We’re not sure yet… LaserShip acquired OnTrac Logistics for $1.3 billion. Combined, they’ll become the largest regional parcel carrier in the U.S. With LaserShip’s foothold in the East Coast and South and OnTrac servicing the West Coast, only ten states extend outside their coverage […]

- Josh Dunham

- October 4, 2021

Consider this: farm-fresh peaches delivered to your door in just two days, tasty pecans right in time for the holidays—all without a trip to crowded grocery stores. That’s what you get when you order direct from Pearson Farm. Based in Georgia, the Pearson family has been tilling the soil for five generations and perfecting their […]

- Josh Dunham

- September 21, 2021

With the end of the year just around the corner, FedEx has announced their 2022 General Rate Increases. Retailers and high-volume shippers beware: this year marks the highest GRI average rate increase since 2013 with the average rate increase for FedEx in 2022 sitting at 5.9%. This is a substantial increase from what was seen […]

- Josh Dunham

- July 19, 2021

- Josh Dunham

- July 15, 2021

- Josh Dunham

- June 24, 2021

With the launch of Reveel’s Shipping Intelligence® Platform, we gave our existing clients early access to the platform. We first talked to Brandon Beasley, the VP of Operations at Gunner Kennels, last year. Driven to keep man’s-best-friend safe in vehicles, the company builds 5-star, crash-tested dog kennels and sells direct-to-consumer online. We gave Brandon and […]

- Reveel

- June 24, 2021

THE INTERSECTION OF SCIENCE, EDUCATION & CRAFT What began as home brewers searching for higher quality yeast, quickly grew into a team of dedicated biochemists exploring new ways to advance brewing altogether. Today, White Labs stands at the intersection of science, education and craft. Constantly striving for perfection, and in the process continually raising the […]

- Reveel

- June 21, 2021

- Josh Dunham

- May 21, 2021

This is the second surcharge increase this month from FedEx. This time the surcharges are on U.S. Express and Ground services and Ground International. Additionally, the peak fuel surcharge tables have been updated to reflect a higher fuel surcharge. If you’re worried about how this might impact you, the Reveel Shipping Intelligence® platform can give […]

- Josh Dunham

- May 7, 2021

As COVID-19 was beginning to impact the global supply chain, FedEx responded in April 2020 by implementing a surcharge on all FedEx Express® and TNT international parcel and freight shipments beginning April 6, 2020. This surcharge made logical sense as containment restrictions among the various countries around the world disrupted the global supply chain. As air cargo […]

- Reveel

- April 22, 2021

What was it like working at FedEx? Although he enjoyed the job, our VP of Operations Nick Nowaczyk noticed a few things that didn’t sit well with him. One, FedEx and UPS charged the same amount to ship comparable packages—down to the penny—despite the many different variables in the two businesses’ operations. And two, Nick […]

- Josh Dunham

- April 7, 2021

On March 23, 2020 FedEx announced the suspension of the Money-Back Guarantee program for all FedEx Express, FedEx Ground, FedEx Freight and FedEx Office services as the onset of the COVID-19 pandemic began disrupting the shipping industry. The suspension of their Money Back Guarantee was implemented immediately and until further notice. On Tuesday, April 6, […]

- Josh Dunham

- April 5, 2021